Which Sector Is Growing Fast In India For Investing In 2025?

India, the world’s fastest-growing economy, is beginning 2025 on a high note. The GDP growth of the nation is estimated at 6.5%–7% on the back of domestic consumption growth, urbanization, digitalization, and government policies.

To business leaders, firms, and investors, there is only one question: Which is India’s quickest-growing industries and most likely to deliver the largest returns in 2025?

This article gives a thorough analysis of India’s fastest-growing industries, possibilities, challenges, and trends, so the promise of large returns from industry in India 2025.

Top Sectors For High Returns In 2025

These sectors, which are expected to shine brightest in 2025, are discussed below with a summary of major drivers, growth areas, and challenges.

| Industry | Growth Drivers & Trends | Opportunities for Returns | Risks & Challenges |

| Technology & IT | Rise in IT exports, digitalization of industries, application of AI, cloud, cybersecurity, and 5G. India remains a global IT talent hotbed. | Software services, SaaS, AI/ML solutions, cloud platforms, automation, cybersecurity businesses. | Currency fluctuations, global demand cycles, shortage of skills, regulatory issues, wage inflation. |

| Renewable Energy | Strong governments move towards green hydrogen, grid-scale solar, and wind. Rooftop and distributed energy falling as grid parity prices decline and accelerating their adoption. | Solar and wind farms, energy storage, green hydrogen, component manufacturing (turbines, solar panels). | Land acquisition, storing is very costly, competitiveness on tariffs, policy lags, and grid stability. |

| Infrastructure | Excessive government spending on roads, railway, metro, ports, and smart cities. Infrastructure is a multiplier of sectors like real estate and EV charging. Infrastructure is a multiplier of sectors like construction, logistics, metro projects, | Cost over-run, delay in land purchase, regulatory approvals, political risk, and funds bottleneck. | PPP models, utilities, and large contractors. |

| Electric Vehicles (EVs) | Government measures and PLI plans, increased environmental awareness, installation of charging points, and technological innovations in batteries. | Government measures and PLI plans, increased environmental awareness, installation of charging points, and technological innovations in batteries. | Mass penetration of financial inclusion, long-tail digital payments, UPI expansion, digital lending, insurance, and wealth consumption technology. |

| Financial Services & Fintech | Mid-income, budget residential property experiences higher demand. Warehouses, data centers, and logistics parks are in vogue. Institutional investment is picking up pace. | Digital lending, fintech start-ups, neo-banks, insurance technology, and microfinance institutions. | Regulatory risk, cyber-attacks, competition, credit defaults, and interest rate volatility. |

| Real Estate | Increasing cost, excess supply in certain markets, regulatory issues, pressure of interest rate, and fluctuating demand. | Residential property, luxury residential projects, commercial leasing, logistics parks, data centers. | Increasing cost, excess supply in certain markets, regulatory issues, pressure of interest rate, fluctuating demand. |

| Agro & Food Processing | Increasing demand for processed food, change in diet, export potential, govt. incentive for cold chains and food parks. | Food logistics, consumer goods branding, Agritech, supply chain management, packaged food, export processing. | Dependence on monsoon, perishability, quality requirements, land fragmentation, price volatility. |

| Electronics & Semiconductors | Semiconductor fabs, R&D and design facilities, EMS players, component manufacturing, and electronic OEMs. | Dependence on monsoon, perishability, quality requirements, land fragmentation, and price volatility. | Large initial capital outlays, shortage of skills, lengthy installation periods, foreign competition, and technology obsolescence at high speed. |

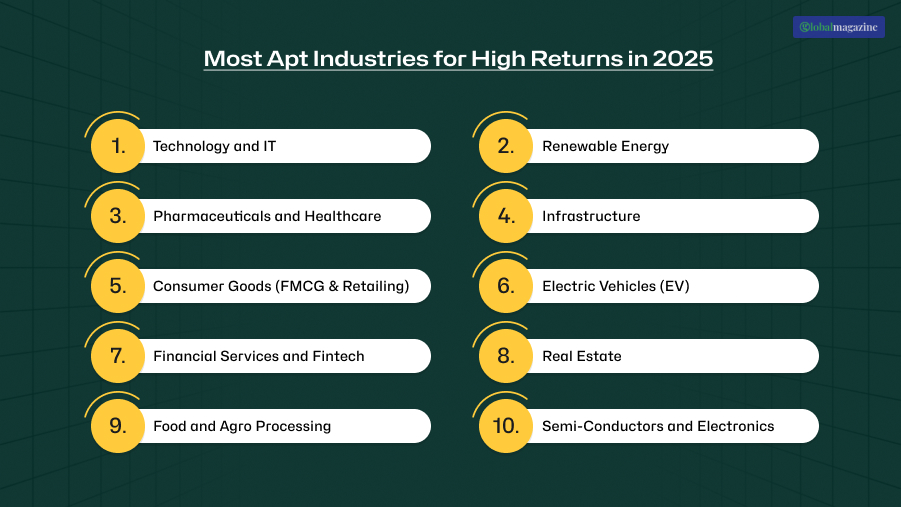

Most Apt Industries For High Returns In 2025

India’s growth narrative is diversified, but these listed below are the most highlighted:

- Technology and IT

- Renewable Energy

- Pharmaceuticals and Healthcare

- Infrastructure

- Consumer Goods (FMCG & Retailing)

- Electric Vehicles (EV)

- Financial Services and Fintech

- Real Estate

- Food and Agro Processing

- Semi-Conductors and Electronics

I will refer to each of the sectors, considering what drives growth, where there are high return opportunities, and dangers to watch out for.

1. Technology And IT

The information technology and IT-enabled services (ITES) sector is the growth engine of India. Valued at over $200 billion annually, the sector is now foraying into newer areas like artificial intelligence, cloud computing, cybersecurity, and blockchain.

Growth Drivers:

- Global demand for digitalization.

- Domestic demand for 5G, AI, and automation.

- Scaling up of software as a service (SaaS) start-up.

- India’s vast reservoir of programmers and engineers.

High-Return Opportunities:

- Cloud infrastructure services.

- AI/ML software solutions.

- Cybersecurity companies.

- SaaS exports to the US and Europe.

Risks:

- Foreign demand dependence

- A global slowdown.

- Skypanda salary bills in IT capitals.

Verdict: Conservative long-term gamble with steady growth and moderate risk.

2. Renewable Energy

India is rapidly becoming a green energy superpower. The government plans to achieve 500 GW of renewable capacity by 2030 by going big on solar, wind, and green hydrogen.

Growth Drivers:

- A fall in solar panel and wind turbine prices.

- Reasonable government incentives, subsidies, and PLI schemes.

- Corporate sustainability goals (companies opting for 100% renewables).

High-Return Opportunities:

- Solar and wind energy projects.

- Green hydrogen and battery storage production.

- Production of parts (turbines, panels).

- Solar rooftop penetration in Urban India.

Risks:

- Land acquisition problems.

- Intermittency in power generation.

- Financing problems.

Verdict: One of the quickest growing industries; ideal for long-term investors.

3. Pharmaceutical and Healthcare

Being one of the leading manufacturing industries in India, the pharma and healthcare sector is worth $50 billion+ and projected to be twice as large by 2030.

With the increasing dependence of the developing world on generic drugs and healthcare needs in the domestic market, the industry continues to grow.

Growth Drivers:

- Rise in incidence of chronic conditions and ageing population.

- Government health schemes (Ayushman Bharat).

- Boosting demand for biotech and medical devices.

- India’s high API and generic drug exports

High Return Opportunities:

- Biosimilars and specialty pharma.

- Telemedicine and digital health companies.

- Tier-2/3 town diagnostic chains.

- Hospital and health infrastructure.

Risks:

- Global regulatory problems.

- Price regulation of medicines.

- Vast capex in hospitals and R&D.

Verdict: Strong export opportunities + growing domestic demand = strong growth.

4. Infrastructure

India is experiencing an infrastructure boom. Government-driven large-sized infrastructure projects such as Bharatmala, Sagarmala, smart cities, and metro corridors, and the government’s National Infrastructure Pipeline (NIP) are driving demand.

Growth Drivers:

- Capital infusion in NIP is worth $1.4 trillion.

- Public-Private Partnerships (PPP).

- Logistics corridor and urbanization development.

High Return Opportunities:

- Highway and road construction.

- Metro, airports, and railway.

- Warehouses and logistics buildings.

- Sanitation, water, and power facilities.

Threats:

- Delay in project delivery.

- Delay in land acquisition.

- Fund issues.

Verdict: Stable, long-cycle business but best suited for high returns in stable times.

5. Consumer Goods (FMCG & Retail)

The FMCG industry is transformed by rising incomes, urbanization, and the penetration of e-commerce. India is among the biggest FMCG markets in the world today.

Growth Drivers:

- Rising spending capacity of the middle class.

- Growth of D2C brands and e-commerce.

- Rural demand growth.

- Premium, organic, and health product demand.

High Return Opportunities:

- Food and beverage industries.

- Personal care and cosmetics products.

- Retail chains based on e-commerce.

- Inroads into Tier-2/3 cities.

Threats:

- Raw material price inflation.

- Change in consumer behavior.

- Extremely competitive.

Verdict: A steady performer; appropriate for medium-risk, stable returns.

6. Electric Vehicles (EV)

Indian sales of EVs have surpassed 2 million in FY2024-25, as the government gave monumental incentives under FAME. 30% of overall vehicle sales will be electric by 2030, according to India’s intentions.

Growth Drivers:

- Clean mobility thrust.

- Decline in battery prices.

- Rise in charging points.

- Indian startup and foreign player penetration.

High Return Opportunities:

- EV car, scooter, and bus manufacturing.

- Battery recycling and manufacturing.

- Charging station network.

- Leasing and financing of EVs.

Threats:

- Huge initial capital investments.

- Foreign nation foreign battery supply dependence.

- Limited charging infrastructure.

Verdict: A sunrise industry with boom growth potential.

7. Financial Services and Fintech

With 10 billion-plus UPI monthly transactions, India leads the world in digital payments. Fintech is transforming banking, lending, and insurance.

Growth Drivers:

- Financial Inclusion of Rural India

- Unanticipated boom of neobanks and digital lending.

- In-penetration of insurtech and wealthtech.

- RBI-friendly regulations.

High Return Opportunities:

- Payment gateways and UPI-based products.

- Micro-lending and buy-now-pay-later (BNPL).

- Online wealth management platforms.

- Insurtech companies.

Risks:

- Rising NPAs in lending.

- Cyber-attacks.

- Regulations are getting stricter.

Verdict: High growth, but returns are at the mercy of the riding regulation.

8. Real Estate

The real estate sector is expanding, with residential and commercial segments both enjoying good demand.

Growth Drivers:

- Urbanization and rising incomes.

- Housing-for-all schemes.

Warehouse And Data Center Demand:

- Metro high-end housing boom.

High Return Potential:

- Premium and high-end residential projects.

- IT parks and data centers.

- E-commerce players’ warehousing.

- Tier-2/3 city expansion.

Risks:

- Low property prices.

- Interest rate volatility.

- Regulatory hurdles.

Verdict: Profitable investment land, which is apt for commercial and quality property.

9. Agro and Food Processing

The Indian food processing industry contributes to almost 10% of GDP and can expand at a better growth rate with government schemes like PMKSY (Pradhan Mantri Kisan Sampada Yojana).

Growth Drivers:

- Demand for packaged foods increases.

- Cold-chain and warehousing infrastructure upgradation.

- Export of processed food enhances.

- Demand for healthy foods and organic foods grows.

High Return Opportunities:

- Packaged food and beverages.

- Cold-chain supply platforms.

- Agro-Tech platforms.

- Seafood, fruit, and dairy export.

Risks:

- Dependence on monsoon.

- Fluctuations in global food prices.

- Bottlenecks in infrastructure.

Verdict: Fantastic long-term wager, especially for value-added food firms.

10. Electronics And Semi-Conductors

The semiconductor manufacturing industry in India is an emphasis area. With PLI schemes and enormous investments, India would be a rival to China-Taiwan.

Growth Drivers:

- Global chip shortage.

- Domestic demand in India for smartphones, EVs, and IoT devices.

- Government support of more than $10 billion for fabs.

- Investments of Foxconn, Micron, and Tata in numbers.

High Return Opportunities:

- Chip design and R&D.

- ATMP plants (assemble, test, and pack).

- Production of consumer electronics.

- Production of IoT and 5G gadgets.

Risks:

- Extremely high capital intensity.

- Long gestation period.

- International behemoths competition.

Verdict: High-risk, high-potential-reward industry.

Quantitative Growth & Market Projections

- Renewable Energy: Already at 220 GW installed capacity with solar and wind projects on steep growth curve. India’s target of 500 GW by 2030 makes it among the highest growth sectors.

- Electronics & Semiconductors: Indian electronics industry growing to USD 300 billion in 2025–26. Fabs and assembly facilities to be set up for high-value investments.

- Real Estate: Size of the market will be $5 trillion+ in 2047. Prices of real property in Tier 1 cities are reporting annual double-digit growth.

- Electric Vehicles: Over 2 million EVs were sold in 2024–25, and over 15% year-on-year demand is increasing.

Key Government Enablers

- PLI schemes for electronics, EVs, batteries, and pharma.

- Subsidy and tax incentive renewable energy push.

- “Make in India” and “Atmanirbhar Bharat” programs supporting local manufacturing industries in India.

- Record infrastructure spending on railways, roads, and airports.

- Digital infrastructure upgradation: Rollout of 5G, broadbanding, and UPI expansion.

- Health schemes like Ayushman Bharat expanding availability of health care.

Dangers To Watch Out For

- Policy and regulatory uncertainty, especially on tariffs and subsidy.

- Energy, commodities, and labor inputs are expensive.

- Bottlenecks in logistics and infrastructure.

- Macro global risks like slowing demand, supply chain failure, and exchange risk.

- Technological obsolescence on account of the fast rate of change in businesses like semiconductors.

- Time-lag environment and deforestation in the context of high-value projects.

Investor And Business Direction

- Invest in companies with strong balance sheets and execution capabilities.

- Invest in our sub-segments (solar, wind, and storage in renewables; EV manufacturing and charging infrastructure in mobility).

- Track incentive and policy trends, directly influencing returns.

- Seek Tier-2 and Tier-3 city opportunities, where demand expansion is greater.

- Invest in sustainable and ESG-compliant businesses, whose valuations are better.

- Invest in export-related businesses, which will most probably gain from alterations in global supply chains.

Top 10 Growing Sectors In The US In 2025

While we are focusing on India, it would be foolish to ignore the growing industries of the US.

With the US economy constantly changing, timing is everything if you are an entrepreneur, investor, or job seeker.

But knowing the right industry to invest in is what matters the most when you are deciding to invest.

So, let’s start with the healthcare industry, despite having a shortage of workers, inflation, and the pandemic problem, the industry is bouncing back stronger than before.

The profit pool is expected to jump from a margin of $605 billion in 20222 to $837 billion by 2027, making a 6.7% CAGR.

The momentum seems to be going strong, with innovation, telemedicine, policy changes, and AI diagnostics helping with the recovery process.

1. Software Development And IT Services

Software is in greater demand as companies become digital-first. Right from apps on your mobile phone to ERP (enterprise resource planning), software development has become the core of business operations.

Cloud computing, SaaS (Software-as-a-Service), and platform development are thriving as companies want flexibility and scalability.

- Growth Drivers: Growth in the digital economy, workflow automation, and rising demand for remote-access collaboration software.

- Opportunities: Cloud integration, bespoke app development, and business intelligence solutions.

- Future Outlook: According to the US Bureau of Labor Statistics, employment as a software developer will grow much faster than average, making it a guaranteed growth industry.

2. E-Commerce And Online Retail

Consumer behavior remains biased towards convenience-based online shopping, price sensitivity, and rapid delivery infrastructure.

Major chain retailers such as Amazon, Walmart, and Shopify are the market leaders, but specialty retail e-commerce sites are also picking up a good pace.

- Growth Drivers: AI-powered recommendations, social commerce (purchasing directly from platforms such as Instagram and TikTok), same-day delivery, and mobile commerce.

- Opportunities: Green e-commerce packaging, direct-to-consumer (D2C) brands, and personalization-driven shopping.

- Future Outlook: In the United States alone, more than 25% of total US retail sales will be online by 2026.

3. Healthcare And Telemedicine

The healthcare sector is growing with a growing population, increasing chronic diseases, and improving technology.

Telemedicine, for instance, became mainstream during the pandemic and continues to grow as patients seek convenient access to physicians.

- Growth Drivers: Artificial intelligence-diagnostic technologies, wearable healthcare technology, and virtual care expansion.

- Opportunities: Telemedicine, electronic health records, personalized medicine through genomics, mobile health apps, wireless sensors for patient monitoring.

- Future Outlook: Telemedicine will continue to play an important role in US health care, cost-saving and access-enhancing.

4. Artificial Intelligence And Machine Learning

AI and ML are no longer science fiction but a way of life, from virtual assistants such as Siri and Alexa to sophisticated predictive analytics in healthcare and finance. Companies use AI to automate, combat fraud, and customize customer experiences.

- Growth Drivers: Explosion in data, automation needs, and use of AI in robotics, healthcare, and the financial sector.

- Opportunities: AI-driven software, predictive analytics, and generative AI solutions.

- Future Outlook: The future of AI in the US will be worth hundreds of billions in the early 2030s.

5. Robotics And Automation

Robotics and automation are transforming industries ranging from manufacturing to logistics. Companies are now going for robots for precision and efficiency because there is no labor, and operating costs are on the rise.

- Growth Drivers: Autonomous delivery systems, intelligent factories, and automated warehouses.

- Opportunities: Industrial automation systems, drones, and robots.

- Future Outlook: Robotics adoption will expand exponentially, particularly in healthcare assistance and e-commerce order fulfillment.

6. Cybersecurity

Cyber transformation also implies that the risk of cyberattacks is even more significant. Cybersecurity has emerged as one of the US’s most critical sectors to safeguard sensitive information in finance, healthcare, and the government.

- Growth Drivers: Increased ransomware attacks, increased cloud usage, and increased data privacy regulations.

- Opportunities: Cybersecurity software, identity theft protection, and managed security services.

- Future Outlook: The US cybersecurity market will be over $300 billion in the early 2030s.

7. Electric Vehicles And Sustainable Transportation

The need for sustainability has placed EVs among the fastest-expanding US companies. Legacy automakers, Tesla, and Rivian are competing to take market share. EV charging stations are also on the rise.

- Growth Drivers: Federal incentives, stricter emissions requirements, and increased consumer interest in clean energy-powered transportation.

- Opportunities: Electric vehicle mobility services, EV charging infrastructure, and battery technology.

- Future Outlook: EVs would be a minimum of 30% of new cars sold in the US by 2030.

8. Wellness And Mindfulness

Increasing numbers of Americans are spending increasing numbers of dollars on their physical and mental health.

The wellness space encompasses fitness technology, meditation apps, nutrition services, and mental health platforms.

- Growth Drivers: Stress reduction, awareness of mental health, and need of integrated living.

- Opportunities: Yoga and mindfulness solutions, health monitoring wearables, and customized nutritional diets.

- Future Outlook: The US wellness economy will grow to more than $7 trillion worldwide by 2025 with solid US contributions.

9. Biotechnology And Pharmaceuticals

Pharma and biotechs are evolving continuously with groundbreaking medications, precision treatments, and gene editing. The pandemic underscored the urgency of fast vaccine creation, driving long-term investment.

- Growth Drivers: Biologics, genomics research, and increasing demand for new drug therapies.

- Opportunities: Rare disease research, CRISPR gene editing, and personalized medicine.

- Future Outlook: The US biotech industry will continue to be a world leader with more collaboration between startups and big pharma.

10. Renewable Energy

Renewable energy is central to America’s transition to a clean energy economy. Solar, wind, and green hydrogen initiatives are advancing quickly with policy backing at the state and federal level.

- Growth Drivers: Climate action, declining cost of renewables, and investment in storage.

- Opportunities: Solar panel installation, wind turbine production, and clean energy investment.

- Future Outlook: Renewable energy will account for almost 50% of all US power generation by the year 2050.

Which Industries Will Dominate In 2025?

India’s highest-profit and fastest-growing industries in 2025 are, according to growth trends, government policies, and investor sentiment:

- Renewable Energy

- Electronics & Semi-Conductors

- Electric Vehicles (EVs)

- Technology & IT

These are sunrise industries driven by policy push and foreign demand. In contrast, Pharma, Infrastructure, and Real Estate will be steady performers with mid-to-high returns. Consumer goods, Fintech, and Agro-processing are steady performers with spread-based growth.

For the investor, an equally diversified portfolio across these high-growth segments can deliver short-term return as well as long-term value creation.