High Risk Merchant Account At Highriskpay.com: Everything You Need To Know

Looking for a dependable way to accept payments in a challenging industry? If your business falls into a high-risk category, think nutraceuticals, online gaming, adult content, or any sector flagged by banks as tricky, you’ve probably faced endless rejection from mainstream payment platforms. This is where the high risk merchant account at Highriskpay.com steps in.

In this article, we’ll break down everything you need to know about this specialized service, its benefits, application process, and whether it’s the solution your business needs.

What Is A High Risk Merchant Account At Highriskpay.com?

A high risk merchant account at Highriskpay.com is designed for businesses often rejected by traditional banks, those facing frequent chargebacks, stricter regulations, or higher fraud exposure.

Moreover, these accounts provide a safe channel for processing card payments even if your business seems “unbankable” to others.

Additionally, you’ll find this essential for industries where regulatory scrutiny and disputes are all too common. For instance, these would include:

- CBD.

- Online travel.

- Debt collection.

- Adult entertainment.

Who Needs A High Risk Merchant Account?

Are you selling digital products, travel packages, or specialized supplements?

Do you regularly ship products internationally or deal with disputed transactions?

If so, you’re likely considered a high-risk merchant. Highriskpay.com opens doors for businesses that otherwise get shut out—whether you’re new, scaling up fast, or simply operating in a niche sector with unique needs.

Typical Features Of A High-Risk Account

These accounts come with built-in protections:

- Rolling reserves (to safeguard against chargebacks).

- Robust fraud prevention.

- Personalized risk assessment.

Yes, the fees are higher, typically 4-6% per transaction, but they’re offset by access to card payments, customer support, and quick approvals. The trade-off? Steadier business and less stress over payment shutdowns.

Why Consider A High Risk Merchant Account At Highriskpay.Com?

Choosing a high risk merchant account at Highriskpay.com is more than just processing sales. Rather, it’s about establishing trust and stability. The platform specializes in high-risk sectors and helps merchants sidestep the headaches of constant rejection. Additionally, it also helps clients find meaningful support.

Industry Coverage And Acceptance

From adult content to vape products and bail bonds, Highriskpay.com shrugs off the industry taboos that stop other processors in their tracks. Moreover, their team works as an ISO (Independent Sales Organization), meaning they match high-risk merchants with banks willing to take on their account, no matter how complex the business model.

Key Benefits And Drawbacks

- Benefits: Rapid approvals (24–48 hours for most), tailored fraud prevention, live support, and broad industry coverage.

- Drawbacks: No advanced analytics dashboard, rolling reserves on your funds, and premium pricing on every transaction. Each merchant needs to weigh these pros and cons, looking at both their short-term cash flow and long-term scalability.

How To Apply For A High Risk Merchant Account At Highriskpay.Com?

Thinking of signing up? Here’s how to make the process as smooth as possible.

Quick Tips For a Smooth Application:

Before you apply, gather all your documents. These would include the following:

- Business license.

- Incorporation papers.

- Photo ID.

- Proof of address.

- Voided check.

- Website policies.

Applications delayed by missing paperwork are a top frustration for new merchants. Additionally, make sure every field matches your official documents.

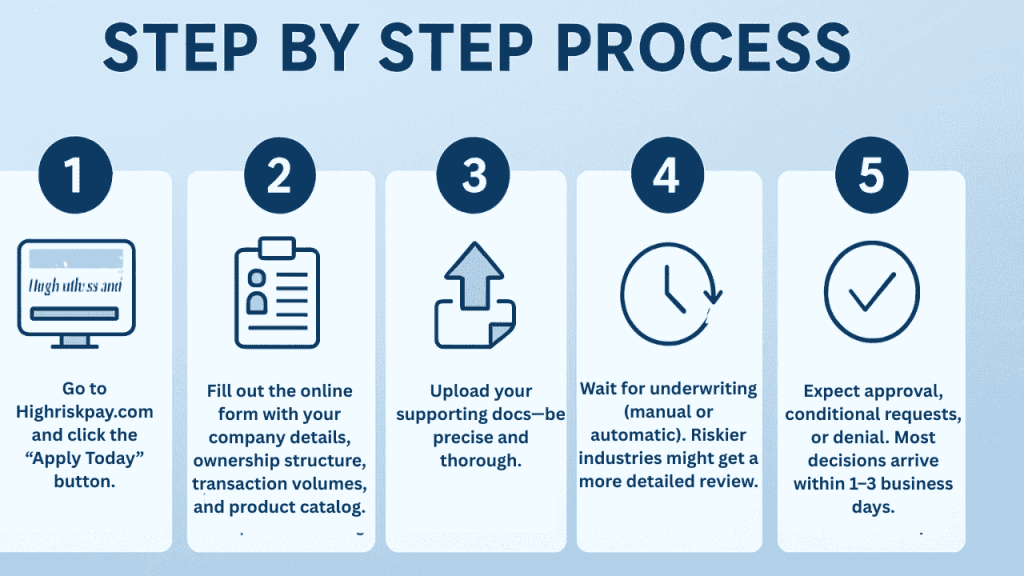

Step-by-Step Process:

Here are a few steps that you need to take:

- Go to Highriskpay.com and click the “Apply Today” button.

- Fill out the online form with your company details, ownership structure, transaction volumes, and product catalog.

- Upload your supporting docs—be precise and thorough.

- Wait for underwriting (manual or automatic). Riskier industries might get a more detailed review.

- Expect approval, conditional requests, or denial. Most decisions arrive within 1–3 business days.

Eligibility And Required Documents

- Incorporation certificate or business registration.

- 3–6 months of payment processing statements (if you’ve sold them before).

- Complete privacy and return policies on your website.

- Up-to-date physical address and photo ID.

- Voided business check and bank letters.

Additionally, you should always remember that preparation sets you apart. Besides, preparing well can also speed up your approval.

Is Highriskpay.com The Right Choice For You?

Let’s be honest: not every high-risk merchant account is right for every business. For instance, Highriskpay.com might be the practical fit for you if you need:

- Instant approval.

- Basic reporting.

- Don’t require deep analytics.

For instance, it’s ideal for companies that find regular rejection on PayPal, Stripe, or Square, and that operate in high-risk zones like gaming, adult content, or credit repair.

However, you should still ask yourself a few questions:

- Do you need more granular control over risk rules?

- Are smart analytics or custom integrations crucial to your strategy?

However, higher fees and simple dashboards mean this is a “get paid fast” solution, not a complex enterprise platform. Additionally, you must review contracts and pricing carefully before you commit.

What Are The Next Steps For High Risk Merchant Account At Highriskpay.Com?

In conclusion, in the world of high-risk payment processing, speed, reliability, and industry experience can make all the difference. And this is something that the high risk merchant account at Highriskpay.com helps you with.

For instance, it helps you in the following ways by delivering:

- Straightforward approvals.

- Solid fraud prevention.

- Customer support.

These are the things that ultimately help prioritize merchants shunned by mainstream banks.

Therefore, if you’re ready to unlock new payment options and move past the red tape, consider visiting Highriskpay.com for a risk assessment and application.

For instance, some of the things that you can do are:

- Evaluate your business needs.

- Read the contracts.

- Prepare your documentation.

Besides, if you are able to do these, you’ll set yourself up for smoother cash flow and fewer payment headaches.

Therefore, if you are ready to take the next step, you can simply sign up! And discover more about high-risk merchant accounts and secure your financial future with Highriskpay.com.