Profitable Intraday Trading Advice By 66UnblockedGames.Com [Explained]

If you have been searching for a quick and easy-to-understand guide on intraday trading, you need to try the Profitable Intraday Trading Advice 66UnblockedGames.Com guide.

Yes, you read that right! A guide for beginners on trading 66UnblockedGames.

In finance, people use the term “intraday” when they’re talking about securities – like stocks and ETFs – that trade throughout the day while the market’s open.

However, as Investopedia rightly states, it’s not just about the trading hours. Intraday also means the ups and downs an asset’s price hits during that stretch.

Short-term traders really watch these swings. They jump in and out of trades all day, aiming to catch quick moves before the closing bell. By the end of the session, they’ve closed out all their positions and start fresh the next morning.

Now, understanding the terms that are related to stocks and trading can be really difficult. Especially for the novices. That is exactly why, as a beginner, you need to take a look at the profitable intraday trading advice 66unblockedgames.com guide.

However, if you want an even clearer gist of the advices that they have provided, keep on reading till the end…

What Is Intraday Trading?

Intraday trading, or day trading, means buying and selling things like stocks, currencies, or commodities all in one day.

According to Groww, the “primary purpose of transacting in this method is to realise capital gains on purchased securities as well as minimise risks by keeping money invested for an extended period.”

The idea is simple: take advantage of quick price changes instead of waiting around for long-term gains or dividends.

How Does It Work?

Intraday trading in 2026 still moves at lightning speed. You’ve got to make decisions fast and keep an eye on the markets all day.

Here’s exactly how it works:

- No Overnight Holding: You can’t hold anything overnight. Every trade has to be closed before the market closes. If you forget, your broker’s going to close it for you at whatever the price is.

- No Ownership Transfer: Since you’re buying and selling within the same session, those shares never actually land in your Demat account—ownership never changes hands.

- Use of Leverage: Brokers also let you use leverage, so with ₹10,000, you can end up trading stocks worth ₹50,000, sometimes even more. That’s how margin works.

- Short Selling: This isn’t like regular investing. Here, you can make money when stocks fall. You sell first, then buy back at a lower price. It’s a different game.

Benefits Of Intraday Trading

At present, intraday trading is still a go-to move for people who want to stay hands-on in the market and see results fast.

The trick is simple: close out every position before the market closes. Doing this comes with some solid perks compared to old-school delivery investing.

Basically, with intraday trading, you face less risk, pay lower commissions, and have a shot at higher profits.

Here are some of the major benefits of intraday trading that you need to know:

- Lower risk.

- Lower commission charges.

- Higher profits.

- Liquidity.

- Capital gains through market fluctuations.

Why Are People Searching For Profitable Intraday Trading Advice 66unblockedgames.Com?

66unblockedgames.com isn’t a finance site, but people keep landing there, hoping to find intraday trading tips that actually make sense. Honestly, trading feels a lot like playing a game—you have to move fast, plan your next step, and pick up lessons from your mistakes.

Back in 2023, 66unblockedgames put out a guide for beginners who wanted to try intraday trading. They left out all the confusing jargon and just got straight to the point – here’s what you do, here’s what you watch out for.

As a result of which, most people who are trying to find a simpler guide on this trading form are flocking to read this guide. And just like they hoped, they are getting a better understanding about the complex trading method.

Read Also: eCryptobit.com Ethereum: The Ultimate Security, Trading, And Future-Proof Investment Guide

Profitable Intraday Trading Advice 66unblockedgames.Com Explained

As I have already mentioned above, 66UnblockedGames shared a really detailed guide for the beginners who are interested in intraday trading:

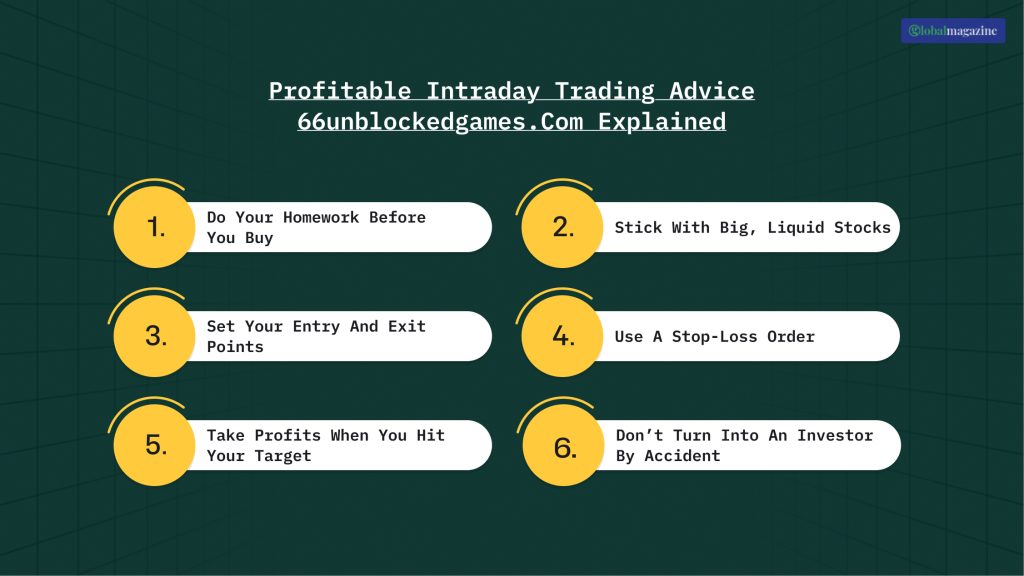

Here is a list of the profitable intraday trading advice 66unblockedgames provides in their blog:

1. Do Your Homework Before You Buy

If you want to make money trading stocks intraday, you can’t just jump in blind. Get to know your top 8-10 stocks – keep an eye out for big news like mergers, bonus declarations, or dividend dates. These things can swing prices fast.

Also, check out where the stock tends to find support or hit resistance. The more you know, the smarter your choices get.

2. Stick With Big, Liquid Stocks

Since you have to close all your positions before the day ends, you need stocks that move easily.

Go for large-cap companies with heavy trading volumes. These are easier to buy and sell quickly, and you won’t get stuck holding shares you can’t unload.

3. Set Your Entry And Exit Points

Before you start trading, figure out your entry and exit prices. Decide where you’ll buy in, and where you’ll get out. Use charts and technical data to help you nail down these numbers.

Once you pick your prices, stick to them. Don’t get greedy or nervous – selling too early, or holding out for a better price, can cost you.

4. Use A Stop-Loss Order

Don’t skip this step. Setting a stop loss protects you if the market goes against you. Just tell your broker your stop price, and they’ll sell the stock if it drops that far. It’s a safety net, so you don’t end up riding a losing trade down even further.

5. Take Profits When You Hit Your Target

It’s tempting to hold on a little longer when a stock’s flying, but that can backfire. If you hit your target price, book your profits.

Don’t get greedy and hope for more. If you see new bullish signals, adjust your stop loss up, but don’t hang on just for the thrill.

6. Don’t Turn Into An Investor By Accident

If your target price never comes, don’t just accept delivery of the shares and wait for a rebound. That’s not what you signed up for.

Stocks picked for intraday trading usually aren’t meant to be long-term holds. Stick to your plan, and don’t let a bad trade turn you into an unwilling investor.