Biitland.com Stablecoins: A New Standard In Digital Stability

In the constantly changing world of cryptocurrencies, stablecoins offer a sanitized sense of security. Fixed on fiat currencies or other assets, they give users the ease of blockchain with less risk.

This niche market is revitalize by one firm in particular: Biitland.com — a new entry into the world of decentralize finance (DeFi). With Biitland.com stablecoins, brings about a safe, efficient, and revolutionary digital economy.

Let us take a look at what Biitland.com stablecoins are, how they stand apart from the others, and why they are unique.

What Are Biitland.com Stablecoins?

Biitland.com stablecoins are cryptocurrencies issuing on the blockchain stabilizing against the physical world assets, primarily fiat currencies such as the US Dollar (USD) or Euro (EUR). Through the icryptox.com web, you can buy, sell, or swap these coins.

The stablecoins are designing to possess a stable value while facilitating frictionless transactions, staking, DeFi application integration, and cross-border remittance on the Biitland platform.

Unlike most cryptocurrencies, such as Bitcoin or Ethereum, which are prone to price fluctuations, Biitland.com stablecoins are built with price stability and trustless usability in mind, both within the Biitland ecosystem and beyond.

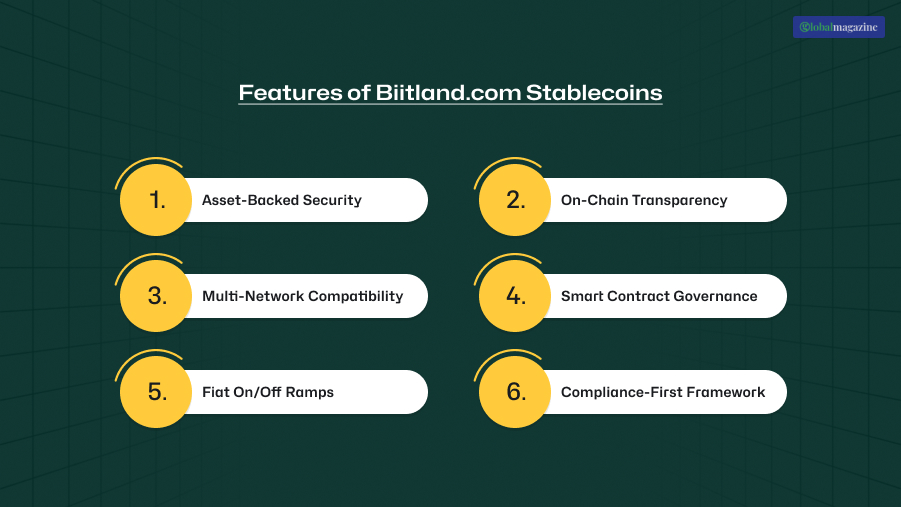

What Are The Features Enhancing Biitland.com Stablecoins?

Here are a few features of Biitland.com Stablecoins that will help you beyond price stability.

1. Asset-Backed Security

Each Biitland.com stablecoin is backed by real-world assets or fiat reserves, securely stored in custodial banks or decentralized vaults. Periodic audits and proof-of-reserve disclosures reassure users.

2. On-Chain Transparency

Every transaction and reserve adjustment is on-chain and transparent, giving users absolute transparency into the management and collateralization of coins.

3. Multi-Network Compatibility

Biitland stablecoins are spendable on several blockchains like Ethereum, Binance Smart Chain (BSC), and Polygon, for interoperability and low-cost spending.

4. Smart Contract Governance

The issuance and distribution of these stablecoins are governed by safe smart contracts, eliminating human manipulation and error.

5. Fiat On/Off Ramps

Fiat is readily convertible to Biitland stablecoins and vice versa by Biitland’s fiat gateways, thus making crypto adoption simple.

6. Compliance-First Framework

Biitland.com follows KYC/AML compliances, thereby making its stablecoin business compliant with global legality.

Biitland.com’s Technological Framework

At the core, Biitland.com employs a modular blockchain architecture optimized for financial-grade applications.

The consensus mechanism with a blend Proof-of-Stake (PoS) with a delegated trust network, while ensuring a quick transaction and a low energy consumption. This is a stablecoin infrastructure.

| Component | Functionality |

| Dynamic Reserve Pools | Adaptive collateral systems responding to market shifts |

| Smart Reserve Oracle | Autonomous oracle layer for pricing and collateral management |

| StableMint Engine | The protocol layer is responsible for issuing and burning stablecoin |

| Compliance Bridge | KYC/AML compliance framework with global standards integration |

| Cross-Chain Gateway | Allows interoperability between Ethereum, Solana, and native Biitland chains |

This robust infrastructure is specially designed to scale without compromising the stability of the users and institutions that it serves.

What Are The Types Of Biitland.com Stablecoins?

When it comes to the different types of Biitland.com then they provide different types of stablecoins, that are tailored to a specific financial application.

1. Fiat-Collateralized Stablecoins

Tagged with traditional currencies such as USD, EUR, or GBP, which ensures minimal volatility.

2. Crypto-Collateralized Stablecoins

Backed by major cryptocurrencies like Bitcoin and Ethereum, it offers decentralized stability.

3. Algorithmic Stablecoins

While utilizing these blockchain-based smart contracts to regulate supply and to maintain the price stability without any direct collateral backing.

4. Hybrid Stablecoins

Combining various types of stabilization methods in order to enhance efficiency and security.

How To Get Started With Biitland.com Stablecoins?

If you’ve been curious about stablecoins but are new, bring this step-by-step guide with you each step of the way—starting with opening an account, through trading, storing them, discovering the risks, and figuring out the future potential of Biitland.com Stablecoins.

1. Create An Account

The first thing to do in order to become a member of Biitland.com Stablecoins is to open your account. It is simple and is designed for crypto newbies and veterans as well.

- Visit Biitland.com – Be sure to be on the site itself to avoid phishing sites.

- Sign Up – Enter at least your email address, password, and country where you live. Use a strong, new password.

- Verify Your Identity – Complete the KYC (Know Your Customer) process by submitting your government ID and address proof. This is to keep up with international financial regulations.

- Enable Security Features – Turn on two-factor authentication (2FA) and, if available, consider linking a hardware wallet for added security.

Once your account is verified and secured, you’re ready to start buying and using Biitland.com Stablecoins.

2. Buying And Storing Stablecoins

Buying Stablecoins

Buying Biitland.com Stablecoins is easy:

- Fund Deposit – You can deposit fiat currency (USD, EUR, etc.) or other currency into your Biitland.com account. Bank transfers and credit card deposits are also an option on some platforms.

- Select Your Stablecoin – Select the available Biitland.com Stablecoin you want to buy and how much you want to buy.

- Put the Buy – The platform will convert your deposited funds into matching stablecoins.

Storing Stablecoins

Biitland.com has a native digital wallet as well, and stablecoins can be safely stored alongside it. As an extra measure of security:

- Consider transferring funds into a hardware wallet or offline cold storage, at least for large sums.

- Always backup your wallet credentials safely.

- Monitor your account for misuse.

The convenience of stablecoins is not only due to stability but also the ease of storing and transferring them borderless without the need for conventional banks.

3. Trading And Using Stablecoins

Once you have Biitland.com Stablecoins, here are some of the ways to utilize them:

Trading

- Exchange for Other Cryptocurrencies – Exchange stablecoins with Bitcoin, Ethereum, or any other coin via Biitland.com’s platform.

- Pair with DeFi Platforms – Give liquidity, earn interest, or participate in decentralized finance (DeFi) activities.

Payments And Transfers

Stablecoins can be used for peer-to-peer transactions, online shopping, or even cross-border remittances. Their value is less fluctuating compared to cryptocurrencies, therefore ideal for routine transactions.

Investment And Savings

- Stablecoins are added to platforms offering interest or yield farming, growing their holding passively.

- Stablecoins are blended with other crypto assets to achieve balanced portfolios, supporting risk reduction while achieving exposure to growth prospects.

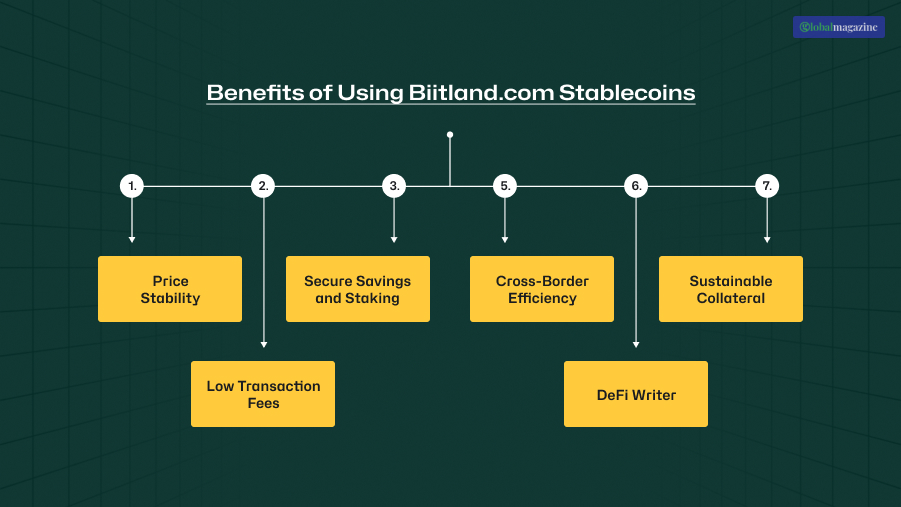

What Are The Benefits Of Using Biitland.com Stablecoins?

Here are a few benefits of Biitland.com Stablecoins that you might find helpful to judge whether you wanna use them or not.

1. Price Stability

Users have access to crypto’s benefits without surprise loss of value — perfect for investors, traders, and everyday users.

2. Low Transaction Fees

With cross-chain and Layer 2 support, Biitland stablecoin transactions are cheap and fast.

3. Secure Savings And Staking

Biitland enables users to stake stablecoins for APY returns, enjoying passive income sources with minimal risk.

4. Cross-Border Efficiency

Instant global transfers with no remittance fees or SWIFT code, ideal for freelancers and multinational corporations.

5. DeFi Writer

BLUSD and BLEUR can be staked into liquidity pools, yield farms, or lending platforms in the Biitland world, a source of extra income streams.

6. Sustainable Collateral

Biitland’s transparency features ensure all coins are completely backed and verifiable — a promise to users.

Difference Between Biitland.com Stablecoins And Other Stablecoins In The Market

Below are some of the important differences between biitland.com Stablecoin and other stablecoins that are on the market.

| Feature | Biitland.com Stablecoins | USDT | USDC | DAI | BUSD |

| Price Stability | High | High | High | Moderate | High |

| Transparency | Audited & Regulated | Varies | High | High | High |

| Blockchain Support | Multi-chain support | Limited | Limited | Ethereum-Based | Binance |

| Liquidity | Growing Rapidly | Very High | High | Moderate | High |

| DeFi Integration | Extensive | Yes | Yes | Yes | Yes |

Biitland.com stablecoins stand out due to their diversity of collateral types, greater utility within a DeFi system, and good emphasis on transparency — features legacy stablecoins lack.

Stability And Security Measures In Biitland.com Stablecoins

There is something important when choosing a stablecoin to rely upon. Biitland.com has unveiled some features of stability and security:

A. Reserve Management

Each Biitland.com Stablecoin is fully reserve-backed, typically with fiat or highly liquid assets. It is thus assured that users get a face value redemption of their stablecoins.

B. Regulatory Compliance

Biitland.com complies with global financial regulatory standards, including anti-money laundering (AML) and KYC compliance. It reduces legal risk for users and enhances overall credibility.

C. Transparency & Audits

The system is also periodically audited to ensure that reserves are kept equal to the circulating supply of stablecoins. Such openness brings trust and ensures users that their funds are secure.

D. Risk Mitigation Strategies

- Cold Storage – The majority of funds are kept offline to protect against hacking.

- Insurance Coverage – A portion of the reserves is covered against unforeseen circumstances.

- Redundant Security Systems – There are several layers of security guarding the user accounts and transactions.

What Are The Risks And Challenges Of Using Stablecoins?

Stablecoins are designed to mitigate volatility, but they are not risk-free. Familiarity with possible risks is essential for all users:

1. Depegging Risk

Stablecoins maintain a pegged value, traditionally to the US dollar or some other fiat currency. Economic stress, market volatility, or insufficient reserves can cause a temporary deviation of a stablecoin from its desired value, also called depegging.

2. Regulatory Uncertainty

Governments worldwide are considering setting up legal frameworks for stablecoins. Future laws can influence:

- Redemption procedures

- Trades licenses

- Tax obligations

Awareness of these threats can allow users to make informed decisions.

3. Cybersecurity

As with all digital assets, stablecoins are vulnerable to:

- Phishing

- Hacking of exchange websites

- Wallet hijacking

People need to use best practices, such as having strong passwords, utilizing 2FA, and holding high balances in secure wallets.

What Is The Future of Biitland.com Stablecoins?

The future looks good for stablecoins, and Biitland.com will be at the heart of digital finance:

DeFi Integration

Stablecoins are key to decentralized finance, in which lending, borrowing, and staking are possible with them. Coupling biitland.com with DeFi protocols allows it to earn interest or liquidity easily without sacrificing the value of their stablecoins.

Global Trade

Stablecoins can even make cross-border transactions easier compared to existing banking infrastructures, which is less expensive and quicker.

Banking Alternative

For users in regions of limited bank access, stablecoins represent a solution to store and transfer value safely, regardless of conventional financial infrastructure.

The application of stablecoins could transform how payments, savings, and cross-border trade are organized in the coming years.

Beginner Tips

Some tips for beginners are below:

- Start Small – Begin with a small amount to try the working of the platform.

- Diversify – Invest using stablecoins backed up by other crypto assets for diversification.

- Stay Informed – Keep yourself updated on platform releases, audit summaries, and regulatory updates.

- Lock Your Purse – Never share private keys and use 2FA for additional security.

FAQs About Biitland.com Stablecoins

Here are a few questions that others have asked on the topic of biitland.com Stablecoins that you might find helpful.

Biitland.com offers reserve-backed stability, regulatory compliance, and transparency, offering stability and simplicity of use for trading as well as everyday transactions.

Yes, the platform is in line with global compliance standards, including KYC, AML, and frequent audits to ensure regulatory compliance.

They can be purchased by:

Depositing fiat or crypto into a Biitland.com account

Selecting the stablecoin of choice

Ensuring purchase in the platform’s trading view

Is It Safe To Use Biitland.com Stablecoins?

Biitland.com stablecoins are not just a digital equivalent of fiat money — they are the foundation of a new-generation financial world where stability, simplicity, and innovation come together.

If you are an investor searching for safe haven in cryptocurrency, a trader looking for a shortcut, or a business wanting to use blockchain payments, Biitland’s stablecoin platform offers a strong, compliant, and scalable solution.

As the crypto universe develops, platforms like Biitland.com that bring user-driven design to the institutional financial level will be essential in achieving mainstream adoption.