GoMyFinance.com Create Budget: The Complete Guide To Smart Budgeting In 2025

Managing your money doesn’t have to be stressful. In today’s digital age, however, tools like GoMyFinance.com make it easier than ever to create, manage, and stick to a personal budget—without needing to be a finance expert.

Whether you’re aiming to save for a vacation, pay off debt, or just get a better grip on your daily spending, GoMyFinance.com creates budget offers a modern, along with an intuitive solution that can transform your financial life.

Today, we will find everything you need to know about budgeting using GoMyFinance.com, from why budget to expert features, comparison, advantages and disadvantages, step-by-step setup guide.

Why Budgeting Is Important?

Budgeting is the key to financial bliss. Not depriving—budgeting is a force of freedom, clarity, and empowerment.

Here’s why budgeting is important:

1. Financial Clarity

A budget tells you exactly where your dollars are going. With clarity, you see wastage, cut back, trim dollars.

2. Aligned With Purpose

Budgets help keep your money spent on what is most important to you—like retiring comfortably, saving for a house, or eliminating college loans.

3. Reduced Financial Stress

By knowing for sure that you can pay your bills, you will feel less anxious and sleep better at night.

4. Debt Elimination

Budgeting through pre-planning enables you to settle your debts and steer clear of high-interest traps.

5. Preparedness

Budgets enable you to open savings accounts, thereby being ready for those unforeseen occurrences such as medical bills, job loss, or car problems.

What Is GoMyFinance.com?

GoMyFinance.com is a web-based, personalized money management service that enables individuals and households to track their spending, build personalized budgets, establish savings targets, and view their financial history on the internet in real-time.

It is a computerized money coach, taking advantage of automation and analytics to simplify money management.

Designed to make spreadsheets and novice software a thing of the past, GoMyFinance.com creates a budget that is exactly what every consumer looking for an in-the-trenches budget solution needs: secure, wireless, and teeming with high-end features.

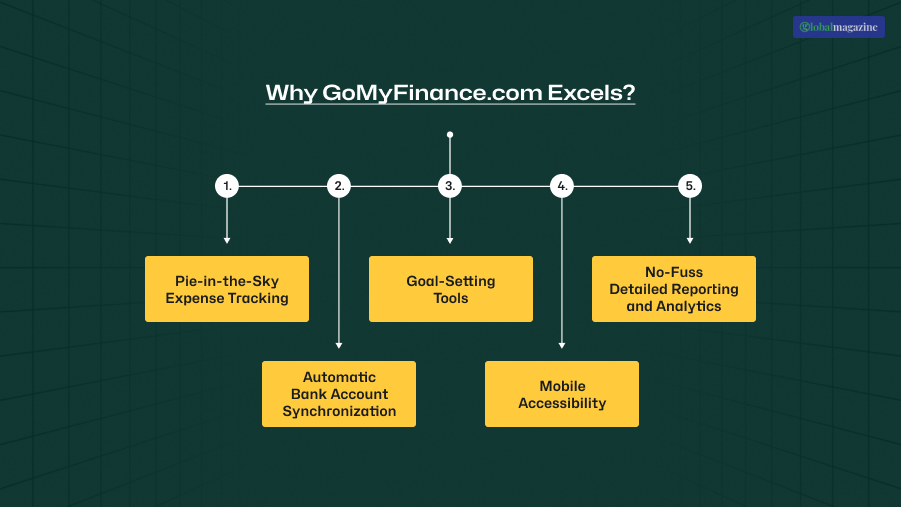

Why GoMyFinance.com Excels?

GoMyFinance.com is not just a budgeting program-it’s a collection of money management tools.

Here’s the closer look at the functionality that separates it from the rest:

1. Pie-in-the-Sky Expense Tracking

Log expenses manually with ease or link bank accounts to log automatically. Expenses are automatically tagged (e.g., food, rent, entertainment) by intelligent algorithms. Re-tag or re-categorize expenses for even more precise reporting as well.

Suppose you took Uber rides and paid $30. GoMyFinance will intelligently tag it under “Transport,” but you can tag it as “Business Travel” too.

Unlike all the other apps, you can create your own budget categories and types with GoMyFinance. Need an “Online Courses” or “Pet Food” category? No sweat.

- Weekly, bi-weekly, and monthly budgeting support

- Dynamic budgets that adjust automatically as your goals and income shift

2. Automatic Bank Account Synchronization

Securely link your accounts:

- Checking and savings accounts

- Credit cards

- Loan accounts

- Investment portfolios (in early beta). Syncing saves you time and keeps your dashboard current as a true reflection of your money status.

3. Goal-Setting Tools

Saving to $10,000 goal or debt-forgiving credit card balances, GoMyFinance.com creates a budget that makes it tangible and keeps it inspiring:

- Progress bars and charts

- Milestone dates marked on timelines

- Automatic transfers (if bank-connected)

4. Mobile Accessibility

GoMyFinance best-optimized apps for iOS and Android, so that you can:

- Track expenses on the go

- Real-time spending check

- Budget limit breach push alert reminders

5. No-Fuss Detailed Reporting And Analytics

Get to know your habits with:

- Trend lines and pie charts

- Spend over time by category

- Budgeted vs. actual spend comparison

- Net worth tracking

Why You Should Be Using GoMyFinance.com to Build a Budget?

Just in case you despise working with Excel or fear finance jargon, however, GoMyFinance.com compensates for it:

- Automation: No longer receipts to balance or hand-drawn charts

- Personalization: Your budget is crafted by you, not the software

- Illumination: Real-time information illuminates and actionable data

- Accessibility: Search anywhere, anytime through mobile sync

- Security: Using bank-grade 256-bit encryption and two-step verification

GoMyFinance.com vs. GoMyFinance.org

Although the titles are probably the same, GoMyFinance.com and GoMyFinance.org are used for quite different purposes.

The biggest difference is:

| Element | GoMyFinance.com | GoMyFinance.org |

| Pinnacle Area of Interest | Budget and Cost Control | Financial Education and Literacy |

| Ease of Use | Very interactive and graphical | Text-based, learning-oriented |

| Key Features | Goal setting, real-time tracking, mobile synchronization | Webinars, worksheets, articles |

| Target Audience | Average users who manage personal finance | Financial novices, teachers, students |

| Mobile App | Yes (iOS/Android) | No dedicated app |

| Cost | Freemium + Premium tiers | Free |

Summary

Use GoMyFinance.com for interactive planning and GoMyFinance.org if you want to learn first about finance.

What Are The Pros And Cons Of GoMyFinance.com?

Just like any other financial tool, GoMyFinancial.com has multiple pros and cons to it. Therefore, here are a few pros and cons that you need to know about.

Pros

- Clean, simple appearance

- Already linked with banks and credit cards

- Excellent support for the mobile platform

- Highly flexible categories and goal tracking

- Spending analysis and top-line reporting

- Encrypted and safe

Cons

- Professional features not available in the free version (e.g., no chart of net worth)

- Sync issues with smaller/local banks

- No investment portfolio management till now

- Very few users have experienced a late customer support response

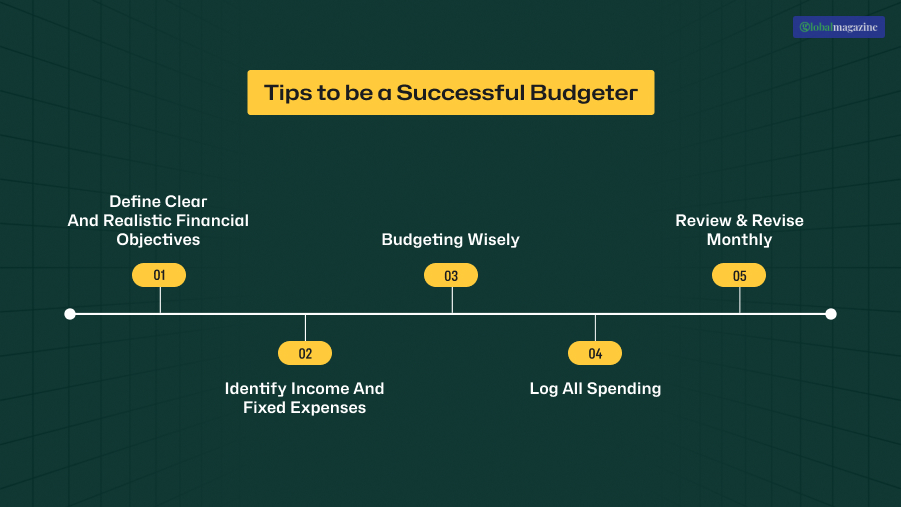

Tips To Be A Successful Budgeter

Irrespective of what tool, budgeting is a habit. Here are tips to be a successful budgeter:

1. Define Clear And Realistic Financial Objectives

Don’t “save more.” Clear, quantifiable objectives like “save ₹50,000 in 6 months as an emergency corpus.”

2. Identify Income And Fixed Expenses

Begin with necessities such as wages, rent, and borrowings. Next, move to discretionary things such as food and entertainment.

3. Budgeting Wisely

Utilize the 50/30/20 rule or develop a personal budget. Saving and paying off debt come before and then discretionary consumption.

4. Log All Spending

Track cash spending manually and follow where money is actually spent on a daily basis.

5. Review & Revise Monthly

Life happens—so does your budget. Balance income, new spending, or financial goals every month.

How To Make A Budget With GoMyFinance.com: Step By Step?

This is how to get started on using GoMyFinance.com to create a budget:

Step 1: Registration And Profile Setup

- Visit www.gomyfinance.com

- Enter minimal details like name, email, and preferred currency

- Choose financial goals (e.g., save more, track spending)

Step 2: Connect Your Bank Accounts

- Link accounts with Plaid or an integrated supporter

- Allow read-only access

- System will bring in fresh 30–90 days of history

Step 3: Set Up Your Budget Categories

- Select or define categories (Housing, Transport, Health, Dining, etc.)

- Define monthly limits from historical facts or personal aspirations

Step 4: Build Financial Goals

- Visit the “Goals” page

- Select a goal type (Savings, Repayment of Debt)

- Determine target amount, time frame, and contribution frequency

Step 5: Check Your Progress

- Look at your budget for health bars

- Look at month-to-month trends and notice where you’re spending more or less

Step 6: Make Adjustments As Necessary

- Rearrange income or expense categories if your personal finances shift

- Use the forecast tool to project future balances

What Are A Few Issues With GoMyFinance.com?

No application is perfect. Below are issues most users have:

- Bank Syncing Delays: Particularly with non-partnered credit unions or banks

- Newbies Learning Curve: Simple, but practice makes perfect

- Paywall-blocked Features and Premium Plan Requirement: Forecasting feature and family sharing feature are paywall-blocked

- Offline Purchases and Cash Spending Still Have to Be Added Manually:

Is GoMyFinance.com Create Budget Worth Using It?

Yes—want a state-of-the-art, one-stop shop where you’re at the wheel of your own finances. You’re a student, working professional, or family administrator—aren’t you the same?

GoMyFinance.com provides smarter, more intuitive, and more integrated budgeting that’s tuned to you.

Begin with the free version to try its features, and upgrade if you wish to access the other features.