Regulatory Change Management: The ULTIMATE Risk Mitigation at Present?

Up next in the series of financial tech is regulatory change management. This belongs to the regulatory technology or Regtech world and how it contributes to the FinTech landscape.

Sustainability across different sectors is at the heart of several approaches and decision-making. Even regulations across the globe are considering sustainability in the long run to optimize their processes.

How does one achieve what’s planned or take hold of the process? Continuous monitoring of processes to ensure they adhere to the rules and regulations. The following article explores how organizations keep track of the road to sustainability.

What is Regulatory Change Management?

Regulatory change management is how businesses align their organization to the regulatory environment that surrounds them. It involves regulations of their industry, country, and regulatory agencies.

The businesses track any updates or other regulatory developments across issuing bodies – it may even be related to wealth transfer. From updating your company policies to standards and controls applicable to the regulations. This ensures continuous compliance with the regulatory standards across levels within your industry.

In addition, regulatory change management includes planning, critical assessment, implementation, and monitoring processes. These steps ensure the organization is aligned with the relevant regulatory requirements. This can even be considered a part of financial planning tips.

Similarly, identifying stakeholders in the business, assessing the impact of regulatory change planning development to address the changes, and monitoring these plans ensure continuous effectiveness.

The digital transformation of several companies is what’s informing the regulatory landscape. Particularly banking and other financial service providers that handle millions of sensitive organizational and customer data. One of the benefits of banking is that the processes are always aligned with the latest regulatory changes.

With the ability of companies to meet challenges, organizations must adapt to bring regulatory change management in place. This will help them ensure compliance with relevant regulations, thereby managing compliance risks.

Many businesses stay compliant with the ever-changing regulations through effective planning. Otherwise, the process can be complex. You need to implement new policies, standards, and controls to bring vital change to your work environment.

In addition, the process is an integral part of compliance and business programs. However, it can be challenging to monitor and implement new changes. This is because it can be difficult to keep up with the changes.

Goals of Regulatory Change Management

The primary goal of regulatory change management is to ensure compliance with regulatory requirements while minimizing disruption to business operations. Just how transaction monitoring is important. Here are a few other goals of this process:

- Coordinate implementation of the regulatory changes across functions and departments through coordinated approaches

- Involve stakeholders to consult and stay current about regulatory changes and their impact.

- Communicate effectively the changes being made in the regulations across all organizational levels. These are essential to ensure the compliance of all affected parties.

- Mitigate risk by managing and implementing processes that control the risks associated with regulatory change.

- Conduct impact assessments by identifying potential business impacts of the regulatory change – could even be how the business loan is approved.

- Monitor the effectiveness of the implementation and the organization’s response to the regulatory change.

- Maintain stability of the organization’s finances and reputation in the market. This is because non-compliance with regulatory standards leads to financial losses.

- Meet requirements by ensuring all regulatory requirements are met.

- Execute timely changes as per the trends and regulatory changes. It is essential to keep the policies relevant, especially in the regulatory cycle, so that the incorporation is better.

Challenges that arise from Regulatory Changes

The challenges that are offered by regulatory changes are essential to point out as they help us understand the steps that should be taken next. Thus, here are the different challenges that organizations face due to regulatory changes:

Interpretation and Ambiguity

Without experience performing audits and working in internal compliance hinders interpretation of regulatory requirements. Moreover, because regulatory changes are fast, factors such as geopolitical shifts, technological advancements, and emerging risks play an important role.

Additionally, the challenge is a driving factor that makes automation and technology adoption difficult. This is mainly due to a lack of knowledge and expertise in security matters and compliance.

Complexity of Regulatory Change

The regulatory landscape constantly evolves due to the technological or FinTech landscape evolution. Changes in technology adoption affect regulatory policies due to the increased chance of risk and security threats.

Keeping up with the volume of regulatory changes and their implications can be daunting. However, it is made easy with the help of proper intimation about these changes.

Regulatory Fragmentation

Organizations operating across different jurisdictions can find it challenging to navigate the regulatory landscape due to the differences. They may overlap or conflict between regulatory bodies, and companies/businesses running across them can be in a fix.

This can pressure the organization to arrange extensive resources across these areas, which can be financially and resource-intensive.

Disrupts Operations

Regulatory changes need to be time-sensitive as they make the workflow compliant and risk-free. However, the operational disruption that occurs goes unnoticed. It is the operations that bear the brunt of implementation, leading to delays and inefficiencies.

In addition, navigating the regulatory changes can affect the operational costs too.

Costs

Emphasizing the previous point, compliance with the regulatory changes requires significant financial investments in bringing departments up to speed. This includes training, processes, and updating systems while investing in hiring specialists.

If one contemplates not choosing the update, it can be financially draining through fines and penalties. Not to forget the legal actions and reputational damages. This is of concern as the amount can be significant compared to any investments or costs in adhering to the regulations.

Time-Consuming

Implementing and complying with regulatory changes can be time-consuming across different levels. However, comparatively, the cost of compliance is bearable and has better ROIs than non-compliance.

Aspects of Regulatory Change Management

There are five main critical aspects of regulatory change management. These are:

- Clear definition of regulatory agencies that apply to the organization. This depends on the location of your operation – someone running a company in the UK cannot be expected to comply with US regulations – even if it is hiring third-party services from there.

- Aligning the organization to the existing regulations as applicable

- Monitoring any upcoming development and relevant regulatory activities such as legislative, enforcement, and changes as applicable.

- Understanding the scope and impact of regulatory change in the existing policies and compliance programs

- Identifying the procedures and processes that will be affected by the regulatory change

- Implementing controls that align with the regulatory changes in attempts to mitigate the risks

- Communicating applicable changes to the relevant stakeholders such as partners, employees, third parties, and executive leadership for compliance across levels.

- Monitoring and reviewing change management plan.

This is what the regulatory change management process entails, and this is what is necessary for complete adherence to the regulatory changes.

Why is it Important?

Tracking regulatory changes is necessary due to the significant impact it can have on the business’s compliance program. This allows the company to operate in different marketplaces and helps it manage risks.

In addition, regulatory changes may originate from different areas of society – from government agencies to issuing bodies and legislators. Moreover, for the business operations to run smoothly, it must adhere to the standards, best practices, and enforcement actions. This helps improve its regulatory expectations.

Thus, regulatory change management becomes essential due to the following reasons:

- Ensures compliance with the latest regulations and styles

- Helps save unnecessary, avoidable costs by preventing penalties and heavy fines

- Helps the companies stay competitive and keep up with the changes ahead of the competition. When the change is robust, the stakeholders adapt better to the implementation.

- Protects consumers as regulations help ensure companies are adhering to the best standards of operation. Thus, it also ensures that the service or product reaching the consumer is safe to use and will not put the consumer at risk – data loss or health concerns.

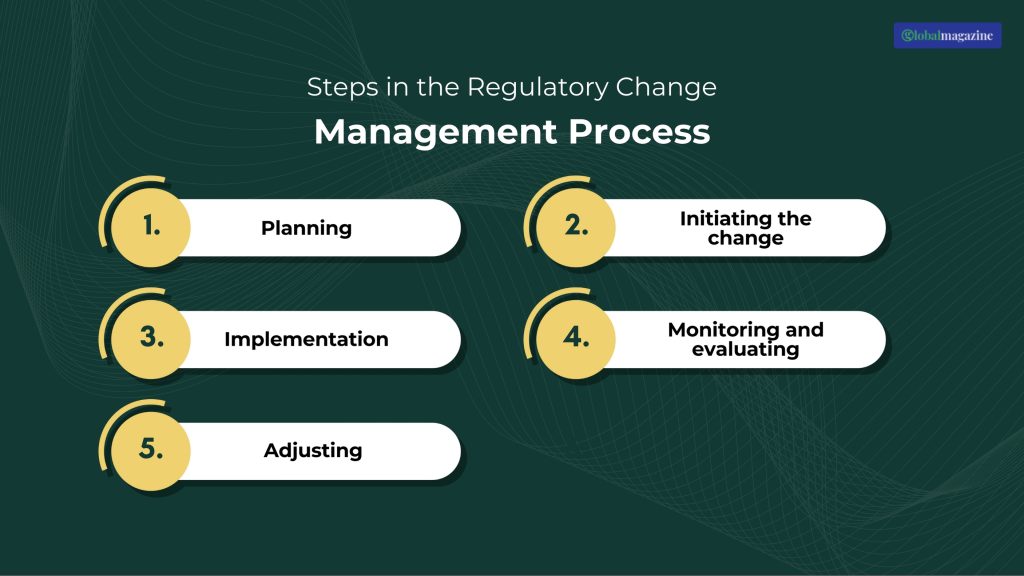

Steps in the Regulatory Change Management Process

It is no rocket science, but the process of regulatory change management includes the following steps:

Planning

This is the step where the goals of the change are identified, which informs the plan development sub-step. This is how the implementation will come into effect. Moreover, it requires the organization to understand the need for change – helping their contribution in implementing it.

Initiating the Change

This is the step that intimates the parties that will be affected by the change. This also includes getting their buy-in to make the process smoother than anticipated. Moreover, the step also includes identifying the specific regulatory changes and if they are relevant to the existing practices at all.

Implementation

This is the step of making the changes identified in the previous step. It is crucial to implement the change effectively in this step. Moreover, this includes the compliance, legal, and risk management teams working on the implementation collectively.

Monitoring and Evaluating

This step is mandatory to assess if the implementation step was successful. The effectiveness of planning is seen in this step, which informs the compliance, legal, and other teams about the next step. Moreover, it also involves assessing the impact of regulatory change on the organization and making any necessary changes in the next step.

Adjusting

This is where any detected requirement for change in the regulatory plan is adjusted. In addition, it also involves maintaining long-term changes so that it sticks.

Wrapping It Up!

The primary reason regulatory change management benefits companies and businesses is cost-effectiveness. Yes, it saves your business significant money when you comply with regulatory changes (specific to your location) and stay current.

In addition, different components of regulatory change management come into effect to bring effective compliance. It is better to invest in compliance than lose financial resources over non-compliance.

Inquire about regulatory changes in your organization today!

Read More: