Why Investing In Renewable Energy Is A Good Addition To Your Portfolio?

The world is drifting away from fossil fuels towards green, clean energy. Environmental concerns, global warming, uncertainty of fossil fuel prices, and rising global energy needs have driven the world towards clean energy.

India has also been leading the way to adopt renewable energy through the policies of the government in the country in the sector of targets, foreign investment from the private sector, and a strategy with countries abroad.

The 21st century has witnessed a huge energy transition in the world. Fossil energy in the shape of coal and oil was ruling the world economy, but now the world is shifting towards renewable energy—greener, cleaner, and sustainable energy.

The transition is fueled by awareness of climate change, advancements in technology, government policies, and investors’ interest in ESG-compliant investments.

India is at the forefront of this change. With aggressive renewable energy goals and huge government investment, India is becoming a center of renewable energy investment with growth value and environmental dividend.

For the investors, it is not a business long-term decision—it’s a ten-year investment opportunity. Knowing which sector is growing fast in India is the India’s renewable energy sector is expanding at historic levels with sustainable market demand, policy support, and technology upgradation benefits.

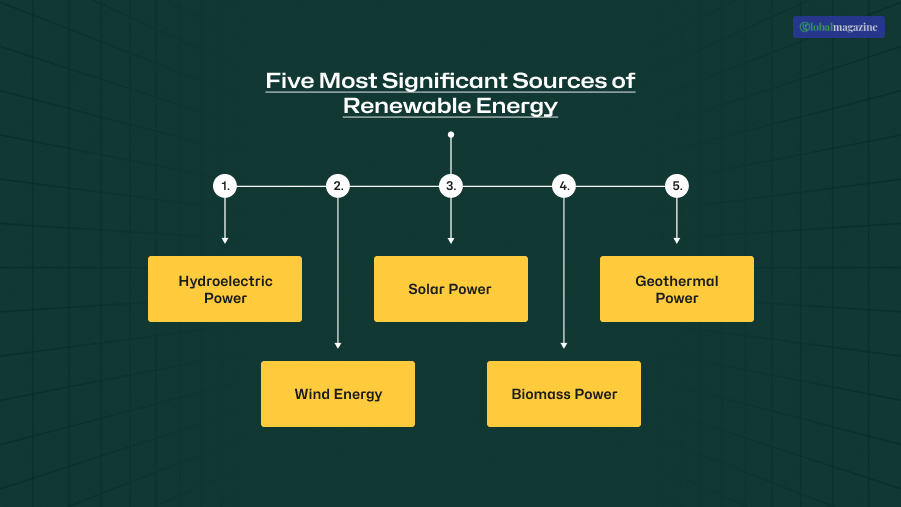

Five Most Significant Sources Of Renewable Energy

Renewable energy is obtained from sunlight, wind, rain, and geothermal heat, which are financially sustainable.

The five most important ones are:

1. Hydroelectric Power

- Definition: Power created by using flowing water’s power, usually in dams and reservoirs.

- Status globally: Hydropower produces almost 16% of global electricity.

- In India: Clean energy dominance with an installed capacity of over 46 GW.

- Advantages: Round-the-clock baseload power, grid stability, support in irrigation and flood control.

- Disadvantages: Nature’s equilibrium disrupted, displacement of populace, dependence on rain.

2. Wind Energy

- Description: Electricity generated by windmills using air movements to provide electricity.

- World status: Account for over 7% of global power generated.

- Indian status: Wind power till April 2025 is 51,058.55 MW.

- Advantages: Abundant along coastal states of Tamil Nadu, Gujarat, and Karnataka.

- Disadvantages: Unpredictable wind speeds, takes up huge tracts of land.

3. Solar Power

- Definition: Power obtained from photovoltaic (PV) cells or solar concentrated thermal power.

- Global location: Solar is the cheapest source of electricity for the majority of the globe.

- In India: With additional capacity of 107.95 GW, solar is India’s largest renewable energy industry.

- Pros: Scale of thousands, lowers installation cost, govt subsidy.

- Cons: Land acquisition, intermittency (no power during night hours).

4. Biomass Power

- Definition: Electricity generated by burning organic waste such as crop residues, forest residues, and animal dung.

- World status: Offers ~5% world’s renewable energy.

- In India: Bagasse cogeneration and others other than bagasse offer ~10,743 MW.

- Pros: Preserves farm waste, rural employment, carbon-neutral if properly managed.

- Cons: Inefficient supply, pollution if not properly managed.

5. Geothermal Power

- Definition: Electricity or heat generated based on temperature of Earth’s crust.

- World status: Extensive usage in the world in Iceland, Indonesia, America.

- In India: Yet to be commercially exploited, commissioned pilot plants at Gujarat and Ladakh.

- Advantages: Base-load power non-intermittent.

- Disadvantages: Geographically location specific, high initial expenditure.

Why You Should Invest In Renewable Energy?

It’s the right thing to do, and it’s a cost-effective long-term investment. Why?

1. Climate Mitigation And Environmental Protection

Investment also reduces coal, oil, and gas consumption, which reduces carbon emissions considerably. This aligns with India’s Net Zero by 2070 vision.

2. Public Health Benefits

Transitioning to renewables reduces air and water pollution, reducing healthcare spending on respiratory disease, heart disease, and water-borne disease.

3. Economic Growth And Employment

Renewables have already created over 13 million jobs worldwide, according to IRENA. India already has over 1 million working in the sector, and in 2030, demand will be doubled.

4. Energy Security And Autonomy

India imports over 80% of crude. Investing in India in renewables makes India less reliant on unstable foreign markets.

5. Access To Decentralized, Low-Cost, And Stable Energy

Mini-grids and building-integrated photovoltaics supply isolated and rural villages.

6. Social Empowerment And Inclusive Development

The poor and women have better access to renewable energy and inclusive development.

7. Climate Resilience And Adaptation

Renewables mitigate reliance on fossil fuel price volatility and variability of natural systems.

8. Investor Confidence And Policy Support

India offers Production Linked Incentive (PLI) schemes, tax benefits, and long-term power purchase agreements (PPAs) with assured returns.

9. Sustainable Market Growth and Innovation

Indian renewable energy sector will expand to USD 500 billion by 2030.

10. Synergy With India’s Climate Targets And ESG

Achievement of ESG goals and alignment with Paris Agreement goals is investor-friendly.

11. Rural And Agricultural Growth Driver

Small-scale solar and biomass sectors generate farm-level revenue opportunities.

12. Global Leadership And Export Opportunity

India can emerge as a possible world-class green hydrogen, solar equipment, and wind technology exporter.

Investing In Renewable Energy?

Some investment options for participants in the renewable energy business:

1. Direct Project Investment

- Investment in a mini hydro project, solar farm, or wind park.

- Colossal amounts of money, but it has direct returns and ownership.

2. Equity Investments

- Stock of companies in the renewable energy business listed on the NSE/BSE.

- Examples: Adani Green Energy, Tata Power Renewable, Suzlon Energy.

3. Mutual Funds And ETFs

- Diversified exposure in clean energy mutual funds like Nippon India ETF Nifty 100 ESG Sector Leaders.

4. Green Bonds

- Green bonds are issued only for schemes of renewable energy by the government as well as private organizations.

5. PPPs And Government Schemes

- National Solar Mission and PM-KUSUM schemes offer an opportunity to investors to invest in those projects that are sponsored by the government.

Types Of Renewal Energy Investment In India

The following developments are being overseen by the Ministry of New and Renewable Energy (MNRE) until April 2025:

| Industry | FY 2025-26 (Apr 1-30) MW | Cumulative (MW) |

| Wind Power | 1020.73 | 51,058.55 |

| Solar Power* | 2299.12 | 107,945.61 |

| Small Hydro Power | 1.50 | 5,102.05 |

| Biomass (bagasse) Cogeneration | 0.00 | 9,821.32 |

| Biomass (non-bagasse) Cogeneration | 0.00 | 921.79 |

| Waste to Power | 0.00 | 309.34 |

| Waste to Energy (off-grid) | 10.70 | 541.57 |

| Total | 3332.05 | 1,75,700.23 |

Note – Solar Power cumulative capacity (107.95 GW) includes:

- Ground-mounted solar plant – 82.39 GW

- Grid-connected solar rooftop – 17.69 GW

- Hybrid projects (solar component) – 2.89 GW

- Off-Grid Solar – 4.98 GW

Top Renewable Energy Investment Trends And Highlights

- India is the third-largest renewable energy market globally.

- Government’s goal of 500 GW of renewable capacity by 2030.

- Spurting adoption rate of green hydrogen and battery storage solutions.

- Rooftop solar is now granted new subsidies and tax rebates.

Trends in Renewable Energy Investment Emerging in India

- Green Hydrogen Economy – India will be 5 million tonnes of hydrogen annually by 2030.

- Offshore Wind Projects – Tamil Nadu, Gujarat are the top ones.

- Battery Storage & EV Integration – Clean energy with electric mobility.

- Corporate Power Purchase Agreements (PPAs) – Amazon, Infosys like big companies going clean power.

Investment In A Renewable Energy Startup In India

Looking for investment opportunities in renewable energy startups in India, well, here are a few questions that you need to answer first.

Why Invest In A Renewable Energy Startup?

- Promotes technology and innovation developments.

- Extremely high growth opportunities in unexplored markets.

- Policy is extremely favorable towards startups.

- Provides portfolio diversification.

How To Invest In A Renewable Energy Startup?

- Corporate Venture Capital (CVC) – Corporate companies invest in startups with an aim of innovation.

- Accelerators and Incubators – Accelerator program like Shell E4 and CleanMax invests in renewable startups.

- Corporate Co-development and Pilots – Corporates co-developing with startups to pilot new technology.

- Adoption and Acquisition of Technology – Corporates acquiring business solutions from startups.

Impact on Indian Renewable Energy Investment

- Government Policies and Initiative Support – Supportive incentives, subsidies, and tariffs.

- Technology Development – Cost reduction in solar PV, low-cost windmills, and better storage.

- Private Sector Investments – Increased corporate investment.

- Infrastructures Expansion – Rural electrification, transmission line, smart grid.

- Climate Change and Economic Implications – Carbon tax policy, global oil price, and climate change effect.

What Is Green Energy Stock?

Green energy stocks are firms that specialize in producing or enabling renewable energy. They include:

- Power producers (solar, wind, hydro, biomass)

- Infrastructure providers (grid, storage, EV charging)

- Technology companies (manufacturers of solar panels, turbines, or batteries)

- Biofuel and waste-to-energy firms

Investing in green energy stocks enables retail and institutional investors to:

- Gain entry to a rapidly growing industry.

- Diversify out of fossil fuel-dependent sectors.

- Facilitate India’s climate and energy objectives.

As opposed to traditional power sector participants, renewable energy entities will be rewarded with tax credits, state incentives, and pro-renewables policy regimes, and hence are a secure long-term bet.

Why India Is A Hotspot For Renewable Energy Investments?

India is the world’s third-largest energy consumer, and its energy demand will double by 2040. India needs green energy solutions alongside industrialization and population growth.

Most compelling reasons why India is investment-ready for renewable energy:

- Aspirational Targets – India has a target of 500 GW of renewable capacity by 2030, of which 280 GW is solar power and 140 GW is wind power.

- Global Leadership – India was a founding partner of the International Solar Alliance (ISA), which enables the use of solar power across the world.

- Policymaking Backstop – Programs such as PLI schemes, green hydrogen mission, and carbon trading regimes are investor-led.

- Cost Savings – Solar and wind power in India is the most affordable in the globe.

- Private Sector Investments – Firms such as Adani Green, Reliance, JSW, and Tata Power are going all out for renewables.

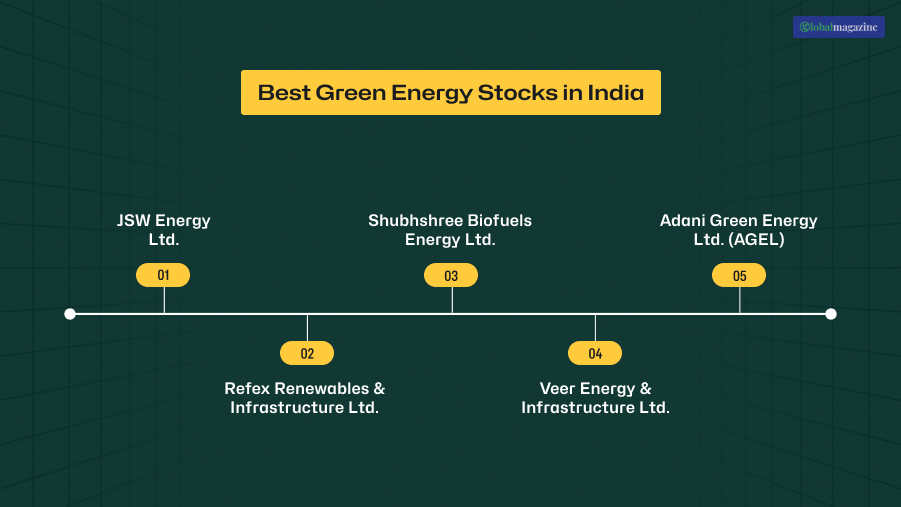

Best Green Energy Stocks In India

Let’s have a look at the best green energy stocks leading India’s green future:

1. JSW Energy Ltd

- Overview: JSW Group’s diversification into the renewable segment from conventional power.

- Portfolio: Solar, wind, and hydro with emphasis on large-scale development.

- Targets: To achieve 20 GW of renewable capacity by 2030.

- Strengths: Stable finances, diversified portfolio, and support by the JSW group.

- Stock Appeal: Consistent performer with long-term growth prospects.

2. Refex Renewables & Infrastructure Ltd

- Overview: Solar power project and carbon trade specialist.

Key Strengths:

- Rooftop solar installation business specialist.

- India’s carbon credit market participant.

- Investor Takeaway: Rooftop solar in India is gaining momentum in rural as well as urban India. High growth specialist.

3. Shubhshree Biofuels Energy Ltd

- Synopsis: Expert in the generation of biomass power from agricultural residues via energy conversion.

- Significance: Raises farmers’ revenues and prevents stubble burning, a behemoth North Indian air polluter.

Strengths:

- Synergies with India’s waste-to-energy and ethanol blending scheme.

- Relying on rising demand for alternative fuels.

- Investor Takeaway: Small-cap with good growth potential but vulnerable to raw material supply risks.

4. Veer Energy & Infrastructure Ltd

- Overview: Engaged in wind energy development and infrastructure support.

Strengths:

- Experience in the installation and maintenance of wind farms.

- Positioning itself strategically as India builds onshore and offshore wind projects.

- Investor Takeaway: Long-term investors looking to bet on India’s wind power trend.

5. Adani Green Energy Ltd (AGEL)

- Overview: Adani Group’s pioneering renewables business, AGEL is India’s largest operating renewables firm with over 10 GW operating capacity.

Strengths:

- Preferred by international investors such as TotalEnergies.

- ~20 GW of development pipeline across solar, wind, and hybrid.

- Leadership in utility-scale solar.

- Stock Appeal: High-growth, high-value stock, proof of investor confidence in India’s clean energy future.

Union Budget Allocations to the Green Energy Segment for 2025-26

The Union Budget 2025-26 was funding India’s green push:

- ₹40,000 crore spent on renewable energy.

- Thrash for National Green Hydrogen Mission.

- Boost for PLI schemes for solar manufacturing.

- Tax relief on rooftop solar and EV adoption.

- Greater emphasis on grid-scale battery storage and smart grids.

This investment promise puts India back on its commitment to a transition to cleaner energy and gets the climate in sync with investors.

How To Invest In The Best Green Energy Stocks In India?

Investors can invest in India’s green energy revolution through:

- Direct Equity Investment – Invest in listed equity shares such as AGEL, JSW Energy, or Refex Renewables on NSE/BSE.

- Thematic Mutual Funds/ETFs – Thematic mutual funds/ETFs will have the market leaders in the renewable sector.

- Green Bonds – There can be special green bonds that can be invested in to fund green projects with guaranteed returns.

- Government Schemes – Government schemes like Sovereign Green Bonds are a safe bet.

- Private Equity/Venture Capital – Solar, EV, or biofuel start-ups can be funded by high-net-worth individuals.

Green Energy Stocks In India: Features

Green energy stocks are defined by positioning and attractiveness:

1. Environmental Orientation

Act now on India’s climate and decarbonization goals.

2. Environmental Resilience

Offer protection against the decline of coal and oil majors.

3. Government Support

Gargantuan subsidies, differential tariffs, and funding benefits.

4. Technological Innovation

Continued innovation in solar panels, windmills, and batteries that makes them more efficient.

5. Regulatory Flexibility

With the ability to carbon credit trading and ESG fit, to meet anywhere.

Renewable Energy Stock Investment Risks

Glossy as it appears, renewable energy investing is risky:

- Policy Risks – Change in government policy or subsidy removal can affect profitability.

- Technology Risks – Sudden changes in technology can render running projects obsolete.

- Market Volatility – Adani Green shares are valuation-sensitive and price-sensitive.

- Financing Risks – Unbinding of upfront capital outlay straightjackets company treasuries.

- Resource Risks – Solar and wind are at the mercy of nature; volatility impacts returns.

Future Prospects: Renewable Energy Investments (2025–2050)

- India’s Supremacy Renewable – To emerge world’s third-largest renewable market by 2030.

- Green Hydrogen Scale-up – LAVISH investments in the production of hydrogen fuel.

- EV & Battery Synergies – Electric cars and batteries are married to renewable energy to power them.

- Offshore Wind Power Farms – India to set up the largest offshore wind power farms.

- Global Comparison – India’s growth in renewables (18–20% CAGR) is quicker than the US (6–8%) and similar to China (20%).

To Sum Up!

Investment in renewable energy isn’t merely an economic decision—it is also a chance to be part of India’s sustainability transformation, energy independence, and world leadership.

With new entrants such as JSW Energy, Refex Renewables, Shubhshree Biofuels, Veer Energy, and Adani Green, India’s green equity market provides retail and institutional investors with alternative opportunities for investment.

With more government policies, greater budgetary spending, and growing energy requirements, renewable energy is a channel for wealth generation in the long run.

For the investor, it is to weigh growth opportunities and risk, diversify among companies and instruments, and be long-term. As the world moves towards a net-zero future, maximum gain will go to those who had made an investment in renewable energy earlier.