Understand The Difference Between Trial Balance Vs Balance Sheet

Trial balance vs balance sheet: are these different terms?

When trying to understand the different financial documents a business creates, uses, and maintains, we often come across trial balances and balance sheets. But many of them are unable to distinguish between them.

There are many differences between them. While a trial balance stands at the first step of creating any company balance sheet, the balance sheet summarizes a lot at the ultimate stage. To simplify, while the trial balance comes almost every month, the balance sheet is readied for each new financial year.

So, if you are struggling to find out the difference between the balance sheet and trial balance, this article should be able to help you.

Trial Balance Vs Balance Sheet: What’s Different About These?

Trail balance is the preparation stage of the balance sheet. You can think of the difference this way. Furthermore, a company creates an initial report every day within the company while preparing the balance sheet.

On the other hand, the balance sheet is the final sheet that they release to financial institutions and different companies.

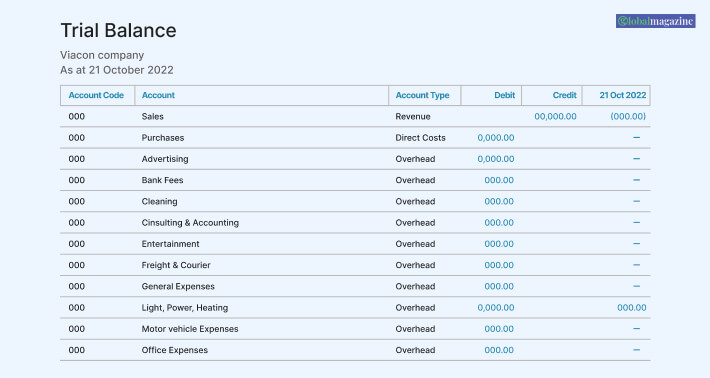

The trial balance is to balance out the credit and debit balances in the account books. Companies often create a trial balance on a monthly, quarterly, or yearly basis.

| Trial Balance Vs Balance Sheet | |

| ⁍ Definition | |

| Trail balance is a statement created for recording the balance from all ledger accounts. | The balance sheet is a financial statement showing the positions of assets and liabilities of an organization at any given time. |

| ⁍ Applied In | |

| Trial balance helps to check if the credit and debit balance tally with each other. | The balance sheet is used to determine the level of accuracy of a company’s financial position. |

| ⁍ Component Of Financial Statement | |

| It is not a component of the financial statement of a company. | It is a part of the financial statement of a company. |

| ⁍ Why Are They Created? | |

| Internal users of information benefit from it. | External users of information benefit from it. |

| ⁍ Frequency Of Recording | |

| A trial balance can be recorded yearly, half-yearly, quarterly, or monthly. | They prepare the balance sheet every year. |

| ⁍ Source Of Data | |

| Data gets collected from a general ledger. | Data gets collected from the trial balance |

You can understand more about each once you read what both of the documents stand for. Here are two easy definitions explaining what trial balance and balance sheet stand for–

What Is Trail Balance?

The record of all the closing balances of a company’s general ledger stands for the trial balance. It helps companies and businesses to check if the debit and credit balances are balancing each other. When the numbers don’t balance out, it calls for a recheck of the books of company to see if there was any mistake in the recording.

The debits and the credits should balance each other out according to the double-entry of bookkeeping. It is necessary to understand the concept of debit and credit to better understand why these figures should be balanced. Here, you can check out the simple idea about credit and debit from the section below.

What Are Credits And Debits?

When posted, a transaction gets recorded in the form of credits or debits. The amount is recorded in one ledger in the form of debt and as credit in another ledger. There is a general rule for recording a transaction. Here is the rule –

- Debit the account whose expenses/assets increase and the revenues/liabilities decrease.

- Credit the account whose expenses/assets decrease, and the revenues/liabilities increase.

What Is Balance Sheet?

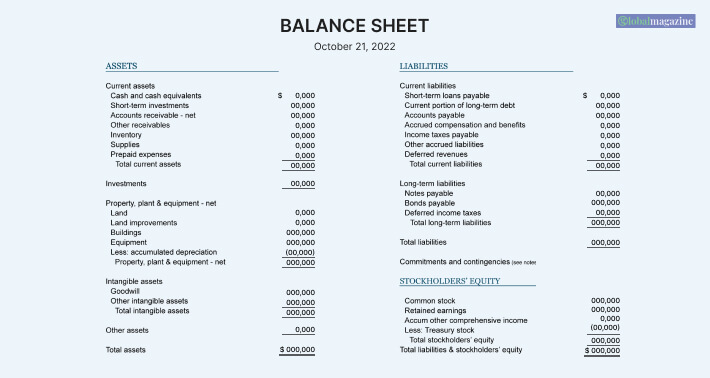

A balance sheet is an ultimate sheet that exhibits different liabilities, shareholder’s equity, and assets of a business. It is also part of the core financial statement of a company. It is used only for internal use. But sometimes, it is also issued to outsiders like investors or lenders. The balance sheet construction follows accounting standards explained in one of the frameworks for accounting. For instance, the GAAP and IFRS.

So, that was the explanation of trial balance vs balance sheet. While the definitions give you a general idea about what each of them means, the difference chat should make it easier for you to understand the whole concept.

Frequently Asked Questions (FAQs):

Here are some popular questions about similar topics. You might be interested to read the answer to these questions.

⁍ It is important for the trial balance and the balance sheet to match. A match in the total credit and debit balance in the trial balance helps build a new accurate statement of income in the balance sheet.

⁍ A balance sheet is created at the end of the year with the closing balance of the ledger accounts – it is why a balance sheet is called the second trial balance.

⁍ As found in Homework. There are the three golden rules of accounting –

(a) Debit the receiver and credit the giver.

(b) Debit what comes in and credit what goes out.

(c) Debit expenses and losses, credit income and gains

⁍ A trial balance is called a trial balance for the following reason – the equal sums on the credit and debit sides of the trial balance.

Bottom Line

Businesses need to create trial balances and balance sheets for the proper financial functionality. Understanding trial balance vs balance sheet will be easy after you read this article. However, if you want to create a balance sheet or trial balance, you should you smart business accounting solutions. They take away a lot of your hard work.

I think you have found the answer to your query. If you have any further questions, you can ask them in the comment below. We will get back to you as soon as possible.

Read More: