Myfastbroker.com: The Leading Broker Matching Platform for New-Gen Traders

Online trading is changing at a breakneck speed. With new markets, financial products, and technologies coming up every year, traders are looking for quicker execution, secure platforms, and intelligent tools.

That’s where Myfastbroker.com enters the scene — a broker matching and trading platform aimed at serving both newbies stepping into trading and professionals seeking advanced capabilities.

Unlike many platforms that only focus on either education or professional tools, Myfastbroker.com offers the best of both worlds.

Whether you’re someone tracking major indices like those covered on fintechzoom.com FTSE 100, or an individual focusing on personal finance tools, such as gomyfinance.com create budget and gomyfinance.com credit score.

This platform creates a bridge between market knowledge and actionable trading opportunities.

What Is Myfastbroker.com? An Overview Of The Leading Broker Matching Platform

Myfastbroker.com is a thorough financial technology (fintech) trading center that functions as a broker matching platform.

Simply put, it serves to match traders with appropriate brokers according to their trading patterns, experience, and investment objectives.

The site ensures that the traders are provided with:

- Speedy execution systems for instant trading.

- A variety of trading assets such as forex, stocks, indices, commodities, and cryptocurrencies.

- Guidance assistance that assists beginners to develop gradually.

- Professional-level analytics for experienced traders.

- Solid security measures to safeguard information and funds.

It’s your one-stop gateway to financial markets, with the bonus of having it customized to your trading experience.

Why Trust Matters In Online Trading?

Trust is all there is in financial markets. Without it, one will be at risk of being a victim of scams, data loss, and untrustworthy brokers.

Myfastbroker.com deals with this by providing:

- Trustworthy broker selection: Only vetted and reputable brokers are suggested.

- Data protection: Through the application of encryption and regulatory standards to safeguard user data.

- Transparent fee structures: No charge without notice or unjustified deductions.

- Customer support: 24/7 support to deal with technical or financial-related issues.

When contrasted with financial news websites such as fintechzoom.com FTSE 100, offering knowledge but not action, Myfastbroker.com establishes trust by doing by ensuring your trades get executed safely and efficiently.

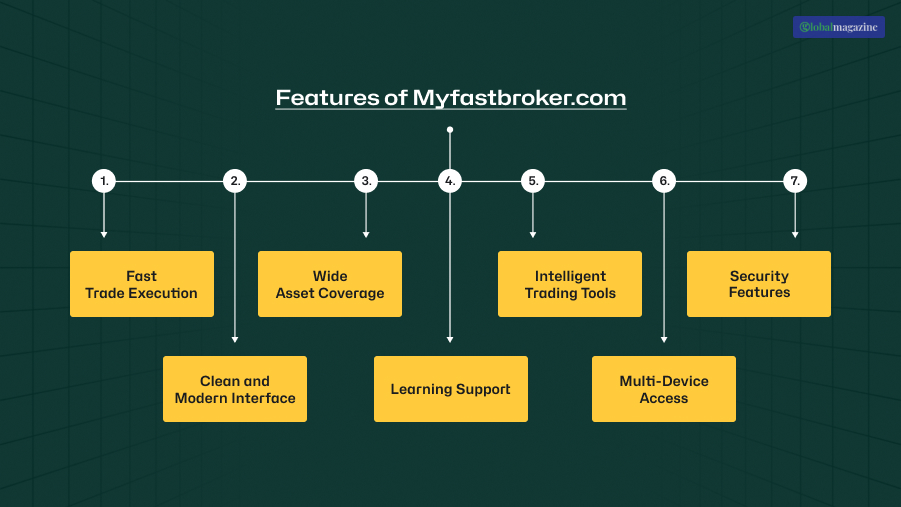

What Are The Key Features Of Myfastbroker.com?

Here’s why Myfastbroker.com is unique in the competitive fintech trading landscape:

1. Fast Trade Execution

Time is money in trading. One second’s delay can be the difference between profit or loss. Myfastbroker.com always focuses on low-latency execution for hassle-free trading.

2. Clean and Modern Interface

The dashboard of the platform is intuitive, minimalist, and mobile-friendly, allowing the traders to spend more time in making decisions and less time in understanding the interface.

3. Wide Asset Coverage

From old-school markets such as forex and commodities to new assets such as cryptocurrencies and international indices (including the FTSE 100), multiple opportunities are available to traders.

4. Learning Support

Myfastbroker.com provides tutorials, e-books, demo accounts, and guided resources for novices. This is similar to sites such as gomyfinance.com create budget, in which learning and instruction give users control over their financial futures.

5. Intelligent Trading Tools

The site features:

- Advanced charting tools.

- Automated trade alerts.

- Risk management calculators.

- Technical and fundamental indicators.

6. Multi-Device Access

Trade on the move or from your office. Myfastbroker.com is accessible across web browsers, Android, and iOS devices.

7. Security Features

Security features include:

- Two-factor authentication (2FA).

- End-to-end data encryption.

- Segregated funds for client money.

- Regular security audits.

What Are The Different Types Of Accounts On Myfastbroker.com?

In order to cater to various traders, the site has a number of account levels:

- Starter Account: Minimal access, demo practice, low deposit.

- Standard Account: Greater access to assets, medium-level tools.

- Professional Account: Sophisticated analysis, quicker execution, greater leverage.

- VIP Account: Personal account manager, special insights, customized solutions.

How Myfastbroker.com Assists Newbies?

New traders are given by the platform:

- Demo trading: Train without losing actual money.

- Step-by-step guides: Explaining fundamentals such as order types, leverage, and market trends.

- Financial literacy modules: Educating traders in similar concepts to how gomyfinance.com credit score enhances financial knowledge.

- Low entry requirements: Facilitating minimum investments for opening up trading.

Professional Advanced Tools

Professional traders require accuracy. Myfastbroker.com provides:

- Algorithmic trading and APIs for autotrading strategies.

- Advanced technical analysis tools.

- Real-time economic calendars.

- Customizable dashboards.

- Unrestricted access to global markets such as commodities, stocks, and indices, such as the FTSE 100 (through fintechzoom.com FTSE 100 insights).

Financial Management With Myfastbroker.com

Being successful in trading is not just about making profitable trades—it’s also about wisely managing finances. Myfastbroker.com is linked with tools and guides that support personal finance platforms such as:

- gomyfinance.com create budget → Traders are motivated to establish financial goals.

- gomyfinance.com credit score → Reminds traders to keep their credit and money habits in order.

This integrated strategy guarantees long-term financial security while trading.

Security And Safety: How Myfastbroker.com Protects You

Security is at the core of Myfastbroker.com:

- Encrypted transactions to prevent hacking.

- Regulated broker partnerships.

- Fraud detection systems.

- 24/7 monitoring for suspicious activity.

- Client fund segregation to prevent mismanagement.

Pros And Cons Of Myfastbroker.com

It is important that when you are initially researching an online trading opportunity then there are certain pros and cons attached with it, so here are the pros and cons of Myfastbroker.com.

Pros:

- Lightning-fast trade execution.

- A huge range of trading instruments.

- Excellent support for beginners.

- Multi-device support.

- Very secure platform.

Cons:

- Advanced functionalities might confuse utter newcomers.

- Premium services might be available on higher-tier accounts.

Myfastbroker.com vs. Other Platforms

- Fintechzoom.com FTSE 100 → whereas FintechZoom is concerned with market news and index tracking, Myfastbroker.com provides direct execution of trades on such information.

- Gomyfinance.com create budget → GoMyFinance focuses on individual budgeting, while Myfastbroker.com applies financial literacy to actual trading.

- Generic trading apps → Myfastbroker.com couples novice training with professional tools, achieving balance.

Who Should Use Myfastbroker.com?

- Novices who wish to learn within a secure environment.

- Intermediate traders who need analytical tools.

- Professionals who require speed and algorithmic trading.

- Finance-savvy users who are concerned about budgeting and credit health.

Steps To Start With Myfastbroker.com

- Registration on the official website.

- Select your account type.

- Pass identity verification (KYC).

- Deposit funds through secure payment methods.

- Begin trading in demo or live mode.

Why Select Myfastbroker.com?

- Reliable platform with transparency.

- Access to global markets.

- Beginner education + professional tools.

- Strong security.

- Access from any device.

Myfastbroker.com FAQs

Here are a few questions that others have asked on the topic of myfastbroker.com that you might find helpful at the same time.

Yes. With demo accounts, tutorials, and low deposits, newbies can begin safely.

Yes. You can trade forex, shares, commodities, crypto, and international indices such as FTSE 100.

FintechZoom offers news and updates, whereas Myfastbroker.com allows you to trade on those updates directly.

Although trading is its core business, the site fosters financial knowledge and prudent spending.

Yes, the site is fully compatible with mobile and desktop computing devices.

Final Thoughts

Myfastbroker.com is not merely a trading website—it’s a total trading ecosystem. With rapid trade execution and intelligent tools for financial education and strong security, it has everything necessary to win in the markets.

Whether you’re analyzing fintechzoom.com FTSE 100 for global market moves, learning to create a budget with gomyfinance.com, or improving your credit score awareness, Myfastbroker.com complements your financial journey by turning knowledge into actionable trades.

It is a platform for every type of trader—from cautious beginners to aggressive professionals—making it a premier choice in 2025 and beyond.